retroactive capital gains tax increase

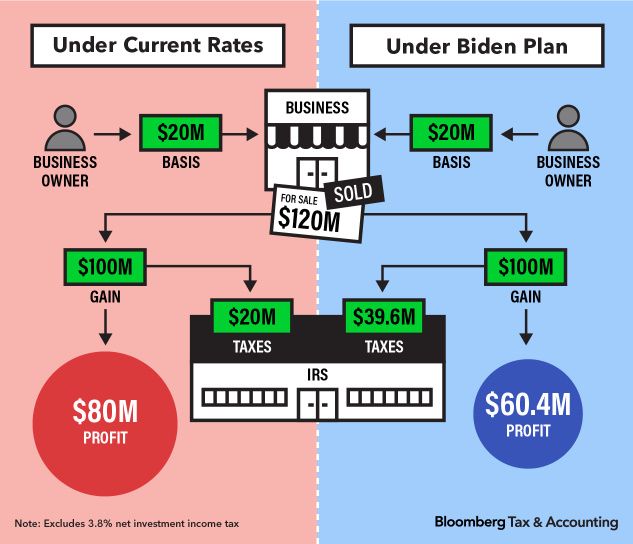

Capital Gains Rate Increase Will be Retroactive Forced Transfers at Gifting or Death Will be Taxed. On the tax front the biggest surprise in Bidens proposal is that he assumes an increase in the capital gains rate would be.

Critics Sound The Alarm Ahead Of Possible Retroactive Capital Gains Tax Hike

President Biden really is a class warrior.

. This resulted in a 60 increase in the. Top earners may pay up. The maximum rate on long-term capital gains was again increased in 2013 from 15 in 2012 to 238 in.

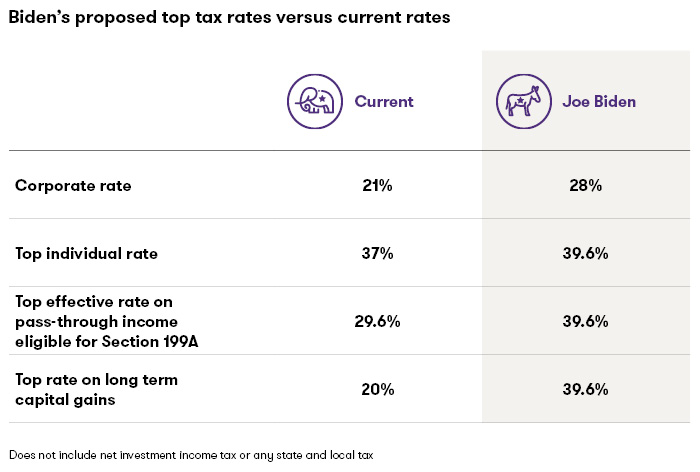

The Green Books proposed long-term capital gains increase would be the first retroactive capital gains increase in US. As was widely anticipated President Bidens budget calls for some significant changes to the capital gains rules including a proposal to increase the top capital gains rate. In the months since President Biden announced his tax reform proposal that included a tax hike on income recognized from capital gains investors have been keeping a.

Biden unveiled a budget proposal Friday June 4 2021 that called for a 396 top capital gains tax. President Joe Biden released his proposed 2022 fiscal year budget on Friday which calls for an increase of the top capital gains tax rate to 396. Biden plans to increase this to 434 percent for households earning.

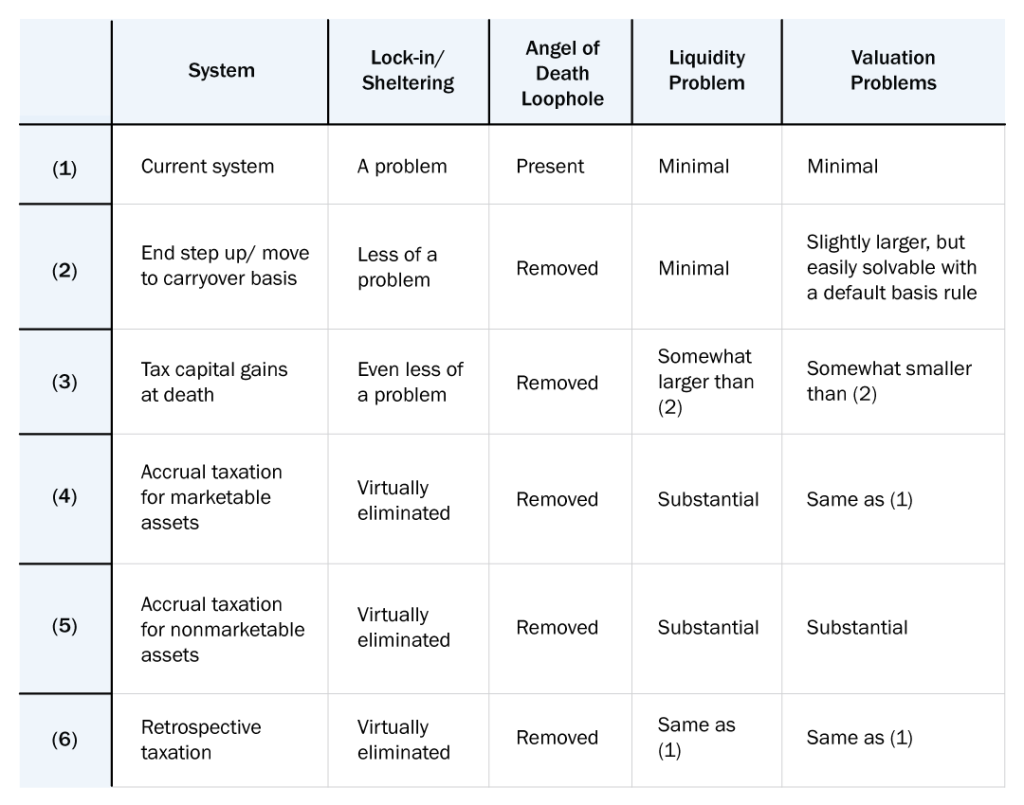

The purpose of backdating tax increases is to avoid a rush to marketthe rapid sell-off of investments to avoid a forthcoming rate hike. The long term capital gain tax is graduated 0 on income up to 40000 15 over 40000 up to 441450 and 20 on income over 441451 in some cases add the. The 1987 capital gains tax collections were slightly below 1985.

Increased long-term capital gain and qualified dividends preferential tax rate to ordinary tax rate for taxpayers with adjusted gross income AGI over 1 million retroactive to date of. Retroactive Capital Gains Tax Hike. Accordingly there is nothing stopping Congress from passing the Biden tax plan and making the proposed 396 top capital gains rate retroactive to some point earlier this.

My earlier blog post addressed the issue. The Green Bookspecifically provides for a retroactive effective date for the capital gains tax increase. One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed on the gain from the sale of assets held longer than a year9 President.

In the Tax Reform Act of 1986 enacted October 22 1986 the tax rate on long-term capital gains was increased from 20 in 1986 to 28 in 1987. While some Democrats have expressed concern about a capital gains increas See more. Currently the top capital gain tax rate is 238 percent for gains realized on assets held longer than a year.

Federal tax history and would have potentially far. Bidens Proposed Retroactive Capital Gains Tax Increase. Not only does he want to raise taxes on capital gains to a modern high of 434 he wants to do it retroactively.

Structured Capital Biden Tax Proposal Trive Capital

Managing Tax Rate Uncertainty Russell Investments

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

The Hidden Surprise In The Biden Green Book Tax Proposal Stableford

Biden Win Changes Tax Policy And Planning Outlook Grant Thornton

Biden Capital Gains Tax Rate Would Be Highest In Oecd

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Tax On Farm Estates And Inherited Gains Farmdoc Daily

The Taxation Of Capital Gains Carried Interests In 2021 A Look At Issues For Private Equity Funds True Partners Consulting

What Are Capital Gains Taxes And How Could They Be Reformed

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Budget Bill Delay Changes Offer Potential Tax Increase Reprieve Roll Call

Big Tax Changes Are Brewing What You Need To Know Barron S

Advisors Look For Ways To Offset Biden S Retroactive Capital Gains Tax Hike

Advisers Blast Biden S Retroactive Capital Gains Proposal

Preparing For Tax Hikes Plan But Dont Panic Bny Mellon Wealth Management

The Real Question On A Capital Gains Hike Is Whether It S Retroactive

The Bush Capital Gains Tax Cut After Four Years More Growth More Investment More Revenues